Download IBM Risk Analytics for Banking Sales Mastery Test v1.M2020-621.CertKiller.2017-05-19.11q.tqb

| Vendor: | IBM |

| Exam Code: | M2020-621 |

| Exam Name: | IBM Risk Analytics for Banking Sales Mastery Test v1 |

| Date: | May 19, 2017 |

| File Size: | 28 KB |

How to open TQB files?

Files with TQB (Taurus Question Bank) extension can be opened by Taurus Exam Studio.

Purchase

Coupon: TAURUSSIM_20OFF

Discount: 20%

Demo Questions

Question 1

Which solution supports balance sheet risk policy for key decision making around effective use of capital?

- Integrated Market and Credit Risk

- Credit Lifecycle Management

- Liquidity Risk & Asset Liability Management

- Collateral Operations Management

Correct answer: C

Question 2

Which solution utilizes a mainly "top- down" approach as opposed to a "bottom-up" approach?

- Algo Liquidity Management

- Algo Strategic Business Planning

- Algo Collateral Management

- Algo Actuarial and Financial Modeler

Correct answer: B

Question 3

When the Spanish Confederation of savings banks (CECA) required a fully automated margin management system from IBM Risk Analytics .which solution did they adopt?

- Credit Lifecycle Management

- Collateral Operations Management

- Strategic Business Planning

- Economic Capital & Solvency II

Correct answer: D

Question 4

Which bank had Q3 2011 revenue adjustments due to CVA which measured in the billions of dollars?

- Citigroup

- JP Morgan Chase

- Bank of America

- All of the above

Correct answer: A

Explanation:

Reference: http://www.prmia.org/sites/default/files/references/CanabarroPresentation.pdf Reference: http://www.prmia.org/sites/default/files/references/CanabarroPresentation.pdf

Question 5

Which role within the bank would be most interested in applying "real-time" risk analytics for better pricing?

- Global Head of Wholesale Banking

- Head of Portfolio Models Market and Credit Risk

- EVP, Head of Risk Management

- VP. CVA Trading Desk

Correct answer: B

Question 6

For banks and financial institutions, the use of institution-wide enterprise risk management (ERM) programs is continuing to grow, what is the current (Summer 2013) share of the institutions which have a ERM strategy in place?

- under 60%

- 60% to 70%

- 0%to 80%

- Over 80%

Correct answer: B

Question 7

Regarding the securities held by banks, which statement is true?

- Banking book securities are actively traded within stock markets

- Valuations of banking book securities are affected by day-to-day market activity

- Trading book securities are typically held until maturity

- Banking book securities include loans and long-term bonds

Correct answer: B

Question 8

According to Banks around the World survey 2013, which bank is now the largest in the world measured on Capital?

- HSBC

- ICBC

- BAML

- J P Morgan Chase

Correct answer: A

Question 9

Which of the following is not a dimension of a Mark-to-Future cube?

- Scenarios

- Time steps

- Exposures

- Instruments

Correct answer: C

Explanation:

Reference: http://www.fam.tuwien.ac.at/~sgerhold/pub_files/theses/schmoeger.pdf Reference: http://www.fam.tuwien.ac.at/~sgerhold/pub_files/theses/schmoeger.pdf

Question 10

Based on the Risk Magazine Technology rankings for Enterprise Risk Management, which statement is false?

- Algorithmics trading platform was ranked in the top five

- Sungard was ranked in the top five

- FinCAD was NOT ranked in the top five

- Market was NOT ranked in the top five

Correct answer: D

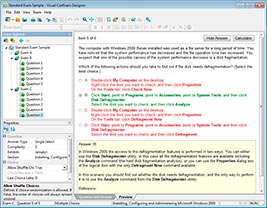

HOW TO OPEN VCE FILES

Use VCE Exam Simulator to open VCE files

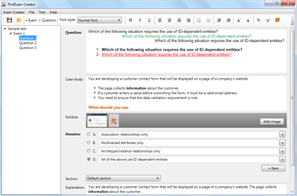

HOW TO OPEN VCEX FILES

Use ProfExam Simulator to open VCEX files

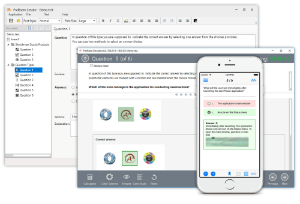

ProfExam at a 20% markdown

You have the opportunity to purchase ProfExam at a 20% reduced price

Get Now!